Abstract

The Unified OLTP (Online Transaction Processing) solution described in this paper proposes a solution for reducing the complexity in having heterogeneous applications and different platforms for Database (DB), Middleware & Applications. Also this solution helps to mitigate the security breaches occur during the data transfer between various banking channels & interfaces, prvides enhanced performance and reduces cost per business transaction.

Currently, an unified OLTP solution for financial service industry is not in the market and the proposed solution increases competitive edge for HP as a solution provider. HP Enterprise Services as a System Integrator (SI) can position this solution as unique and can save money for customer by avoiding license costs from vendors like Oracle.

Problem statement

The financial services industry is undergoing many significant transformations and as it grows, silos inevitably arise within bank’s IT infrastructure. Silos arise owing to globalization, mergers, acquisitions, de-regulation and diversification of the financial services industry. The existing banking solution has complex and heterogeneous applications like CBS (Core Banking Solution) and channels like Treasury, SWIFT (Society for Worldwide Interbank Financial Telecommunication), RTGS (Real-Time Gross Settlement), GBM (Government Banking Modules), Internet Banking, Mobile Banking and IMPS (Immediate Payment Service).

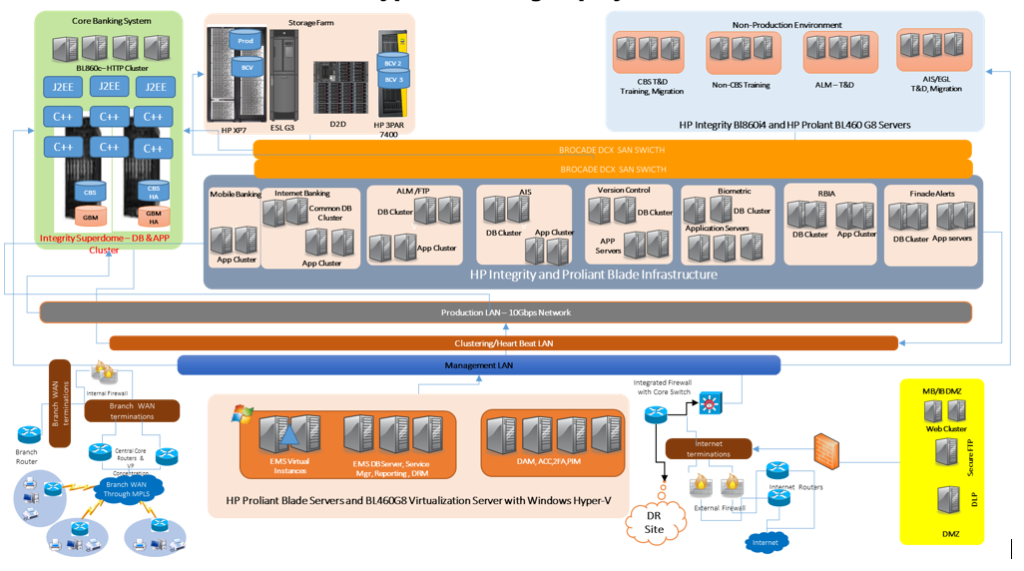

Typical Deployment architecture of a Bank

All these solutions are on different platforms of Database, Middleware and Applications from various ISVs. Such setups increases the complexity of Application Architecture and pose a threat to data security when data/message exchanges happen between various channels and interfaces. This also increases the investment on “Risk & Security” applications like Bio-metric, 2FA (2 Factor Authentication), Online Anti-money Laundering, Integrated Risk Management, Privileged Identity Management etc.

The data upload and interfaces between security solutions to core systems increases non-business transactions which in turn increases systems utilization and scaling of infrastructure. This scenario also results in very high cost per business transaction. Moreover any quality issue with the service must be eliminated if a financial service provider wants to retain a loyal client base.

Solution

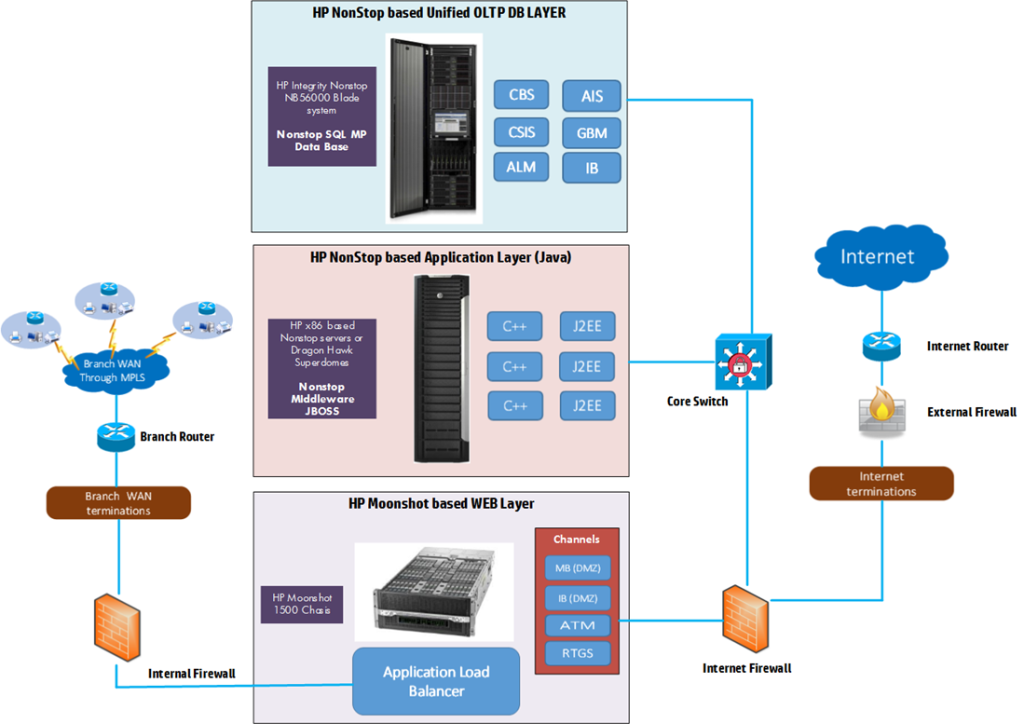

The proposed architecture will provide a unified OLTP Database and application platform using HP NonStop Server Architecture with HP NonStop SQL MP. HP NonStop is designed specifically for the very highest availability level – AL4, connoting that the end-user experiences no perceived interruption based on the use of fault-tolerant servers. In this level, the combination of multiple hardware and software components allow a near-instantaneous failover to alternate hardware/software resources so that business processing continues as before without interruption.

Attempting to break all boundaries, today’s financial criminals use every conceivable method to hack into networks and steal funds—up to $10 billion each year. One way to block fraudulent transactions is to review every transaction—a very costly solution in terms of both time and resources, and one that is out of reach for many card issuers, acquirers, and processors, as well as large retail organizations and network providers. HP NonStop offers on-platform system security, integrated volume-level encryption, and in motion or at-rest data security. With applications from HP partner “BPC Banking Technologies” and Retail Decisions (ReD), enterprises can take advantage of a complete solution to counter growing debit and credit card fraud, as well as risk management. NonStop systems with an in-built Automatic Transaction Monitoring Facility and Audit Trail provides superior transaction security.

The DB Layer will be comprise of NonStop SQL MP which can handle the massive financial transactions. NonStop SQL/MP runs only on HP Integrity NonStop Blades which uses MPP (massively parallel processing) architecture. Unlike the more common machines used for Oracle installations, a NonStop node, a single NonStop Server “box,” is within itself a cluster of up to 16 SMP (symmetric multiprocessing independently running logical processors, each using exactly the same operating system version from the same system disk – and its own unshared memory). To ensure fault tolerance, a NonStop node always contains at least two logical processors. Its scalable too. Since the operating system is message-based and inherently “cluster aware,” clustering configuration and management tasks are minimal.

Most of the Banking applications supports Application logic or Middleware based on IBM websphere, Oracle Weblogic and JBOSS. In our solution application layer will be formed using Nonstop Application Server for JAVA (NASJ). The Web layer will be implemented using HP Moonshot systems. Along with the lowest TCO (Total Cost of Ownership) in its class4 based on initial capital expenditures, ongoing operational costs, and cost of downtime, further reductions will be realized from automation and integration. NonStop offers on-platform system security, integrated volume-level encryption, and in motion or at-rest data security. Enterprises can take advantage of a complete solution to counter growing debit and credit card fraud, as well as risk management. It has got in-built audit trail system and most Banks are using it for ATM (Automated Teller Machine) and PG (Payment Gateway). It also has in-built DB (Nonstop SQL MP) which can be implemented for enterprise customers.

Evidence the solution works

The proposed solution is a conceptual design and a POC will need support from ISVs that develop the applications like CBS and for various banking channels on NonStop platform.

The scalability, data integrity, and end-to-end security of HP NonStop ensures the agility that financial institutions need and is the platform of choice for card processing and electronic funds transfers (EFT) in the financial institutions today. With the platform’s ability to quickly scale resources for real-time, high-volume transactions its success in the solution proposed here is not questionable.

Competitive approaches

Currently, An unified OLTP solution for financial service industry is not in the market and the proposed solution increases competitive edge for HP as a solution provider. However Exadata addresses some part of it for OLAP (Online Analytical Processing), but it has complexities in managing the backup and patch management. Also the license cost is very high which increases the TCO (Total Cost of Ownership) for the customer.

Current status

The proposed solution is a conceptual design and a POC will need support from ISVs that develop the applications like CBS and for various banking channels. Non-stop already used in many stock exchanges and financial institutions worldwide which controls 85% of their financial transactions. NonStop has long-standing partner relationships with Logical and Software Integrators for mature, wholesale payments solutions.

Next Steps

HP Enterprise Services as a System Integrator (SI) can position this solution as unique and can show a better TCO for the customer by providing a Fully-integrated stack of hardware, operating system, database, and app services at a lower cost with enhanced performance and security.

References

[1] Keeping payments processing – HP NonStop for financial services

http://h20195.www2.hp.com/V2/GetPDF.aspx/4AA4-2829ENW.pdf

[2] HP NonStop SQL database & HP NonStop with BPC Banking Technology

http://h17007.www1.hp.com/in/en/enterprise/servers/integrity/nonstop/nonstop-sql.aspx#.VEFa7hZNd8Q http://h22168.www2.hp.com/in/en/partners/bpc/